The internet is abuzz with the return of the meme stock era! Buckle up for a rollercoaster ride as we delve into the recent surge of GameStop (GME) and AMC Entertainment (AMC) stocks, fueled by the legendary figure – Roaring Kitty.

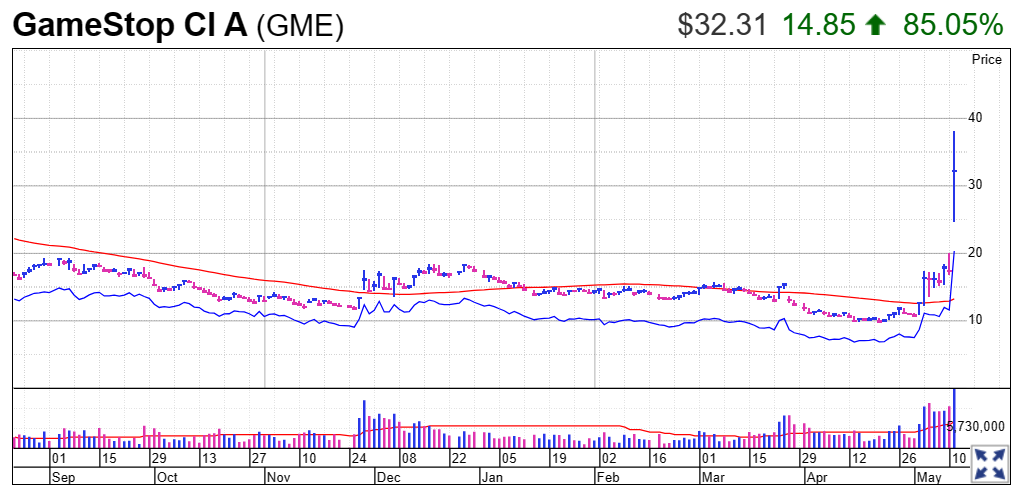

Get ready for a blast from the past, internet! The meme stock era, a time of wild market swings and retail investor defiance, seems to be roaring back. In a stunning turn of events, shares of GameStop (GME) and AMC Entertainment (AMC) skyrocketed by over 70% each on Monday, sending shockwaves through the financial world. But what sparked this sudden surge? Buckle up, because the answer lies in the return of a legendary figure: the one, the only, Roaring Kitty.

For those unfamiliar with the lore, Roaring Kitty, also known as DeepF**ingValue on Reddit, was a hero (or villain, depending on your perspective) during the meme stock frenzy of 2021. This anonymous figure, later revealed to be Keith Gill, a former financial professional, became a beacon for a new generation of retail investors. Through his Reddit posts and livestreams, Gill – a.k.a. Roaring Kitty – fueled the fire for heavily shorted stocks like GameStop, leading to a historic short squeeze that sent Wall Street scrambling.

Fast forward to today, and Roaring Kitty has emerged from a three-year hiatus, sending the meme stock universe into a tizzy. His online reappearance, a simple post that garnered tens of thousands of likes within hours, was all it took to reignite the fervor. This, coupled with continued investor interest in the potential turnaround stories of GameStop and AMC, created a perfect storm for another meme stock rally.

But is this just a nostalgic echo of 2021, or is there something more substantial at play? Here’s a breakdown of the key factors driving this resurgence:

- The Roaring Kitty Effect: There’s no denying the influence this enigmatic figure holds. His return sent a jolt of confidence through the retail investor community, reminding everyone of the potential power they wield collectively.

- The Underlying Businesses: Both GameStop and AMC have been making significant strides to improve their core businesses. GameStop’s focus on e-commerce and the growing NFT marketplace has investors hopeful for a future beyond brick-and-mortar. AMC, on the other hand, has been steadily recovering from the pandemic, with movie theater attendance showing signs of life.

- Short Squeeze Speculation: Let’s face it, the potential for another short squeeze remains a tantalizing prospect for many retail investors. While the market dynamics are different this time around, the short interest in both GME and AMC remains relatively high, keeping the possibility alive.

However, a note of caution is necessary. The meme stock phenomenon of 2021 was a wild ride, filled with extreme volatility and risks. While the current situation might seem similar, it’s crucial to remember that past performance is not necessarily indicative of future results.

Here are some things to consider before diving headfirst into this renewed meme stock frenzy:

- Do your own research: Don’t blindly follow the hype. Understand the fundamentals of GameStop and AMC before making any investment decisions.

- Beware of volatility: Be prepared for significant price swings in both directions. These are not stocks for the faint of heart.

- Invest what you can afford to lose: Meme stocks are inherently risky. Only invest what you’re comfortable potentially losing entirely.

The return of Roaring Kitty and the subsequent surge in GME and AMC have undeniably captured the attention of the financial world. Whether this is a fleeting resurgence or the start of something bigger remains to be seen. One thing’s for sure, the meme stock saga is far from over. So, grab your popcorn (or video game controller), because this is one market drama you won’t want to miss.

This is just the beginning of the conversation. What are your thoughts on the meme stock comeback? Will Roaring Kitty’s return lead to another short squeeze? Share your insights in the comments below!

Disclaimer:

This article is for informational purposes only and should not be considered financial advice. Please consult with a financial professional before making any investment decisions.sharemore_vert